Interest in ethical and sustainable issues has exploded over recent years and today we can see these issues start to influence those in the financial investment community. Investors are increasingly taking into account non-financial factors in their portfolio selection, including the impact a company has on the environment and society.

This shift was compounded yesterday as US President Biden issued an executive order requiring development of a comprehensive government-wide climate risk strategy. This strategy will influence how and where the US Government directs it’s annual $680 billion budget for goods and services. It also sets in motion plans to revise the Trump-era rules that required pension fund managers to put their members financial interests ahead of climate change and other environmental issues when allocating funds for investments.

The winners in this process will be those companies and suppliers that score highly on environmental and sustainable measures.

ESG (Environment, Social and Governance) Ratings

But how do investors identify and select investments based on non-financial measures such as environmental impact?

This is where ESG (Environment, Social and Governance) Ratings come in. These ratings provide a numerical value which scores how ethical or sustainable a company is. One of the market leaders in providing ESG Risk Ratings is Sustainalytics, a Morningstar company.

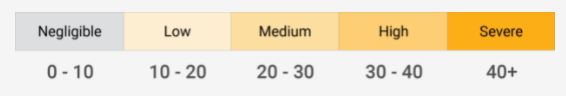

They provide Risk Ratings, for many companies, which are scored on a scale from 0 to 40+, with low numbers representing a low risk and high numbers indicating a high risk/impact:

Building the Portfolio

We’ll start with the S&P500 and just look at the top 30 largest companies. We want to rank these companies based on their ESG ratings and for this we can use the ESG Excel formulas provided by the Excel Price Feed Add-in.

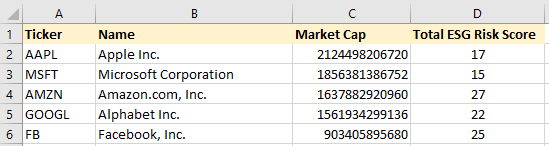

Here is the top 5 stocks in the S&P500, we have added formulas for Market Capitalization and ESG Total Score:

This is a good start but we can improve it considerably by using some of the Excel data visualization tools. For example, we can add a “Heat Map” effect to the ESG Risk Score, this will enable us to quickly see which stocks have a high or low score. We can also add a “Data Bar” to the Market Cap column so we can easily compare the size of the company.

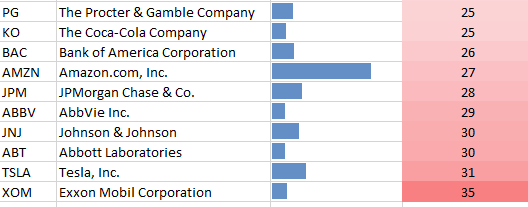

We can also use the Excel Data-Sort function to sort our list by ESG Risk Score, this gives us the following for the top 10 stocks:

And for the bottom 10:

It was not a surprise that Exxon at the bottom, but I was surprised to see so many pharmaceutical companies represented in the bottom 10.

We can refine our data further by not only comparing the stocks against each other but against their peers. For example, a company might have a relatively good score compared to the general market but not perform well against its peers, i.e. companies operating in the same industry/sector.

I’ve added a further two columns, one showing the risk score for its peers, and another showing the difference compared to its peers. I have also used a “Data Bar” to highlight the difference: a red bar (negative) indicates a score lower than its peers (a good thing) whereas a blue bar indicates a higher score.

Here is the a full ESG analysis of the top 30 stocks in the S&P500:

Hopefully this gives you some ideas on how you can go about building your own ethical portfolio.

Visit the Excel Price Feed website to download the Add-in to provide all the Excel formulas used to build the spreadsheet shown above.

Does your software also deliver the individual stock symbol’s average daily volume ?

LikeLike

The Add-in provides 2 formulas for average daily volume.

-Average daily volume over past 10 trading days: EPF.Yahoo.AverageDailyVolume10Day

-Average daily volume over past 3 months: EPF.Yahoo.AverageDailyVolume3Month

More details in the User Guide: https://www.excelpricefeed.com/userguide/excel-formula-yahoo-finance/stocks

LikeLike